7M+

transactions every month

For Banks

Stay Together.

Stay Ahead!

Integrated Turnkey Solutions for Banks – Merchant in Box, Omni-Channel Unified Payment App, White Labeled Customized POS Device, Co-branded Connected Banking Platform

Technology Services

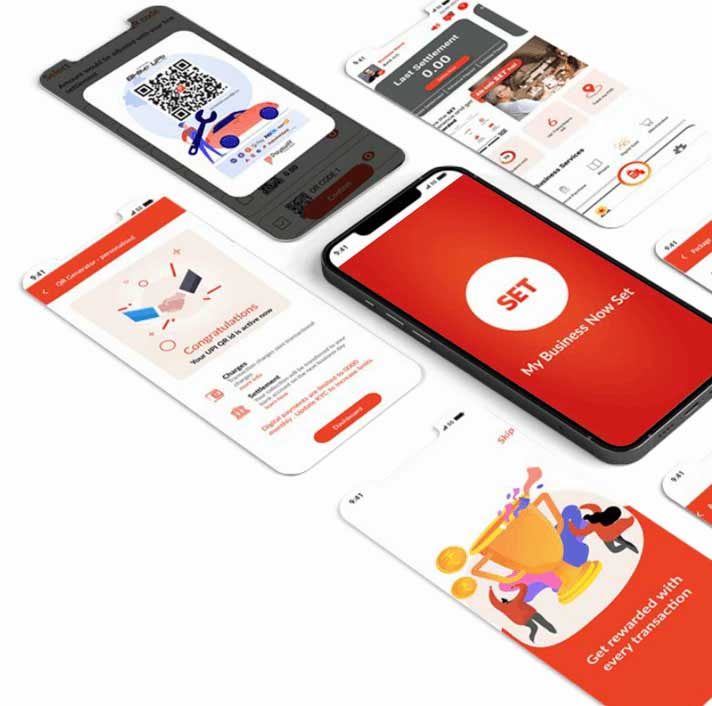

Digital Transformation worth Experiencing

Technology Infrastructure Service – End-to-End Payment Processing, KYC management, Settlement Stacks, Unified Payment App and many more.

For International

Local Presence.

Global Expertise.

Our strong network with International Banks and organisation revolves around a broad range of commerce via technology services & integrated solutions

Blog

Customer Service : An important aspect of business

India – the great nation with its varied minds, language and cultures has one common expectation – fundamental happiness. The happiness does not essentially come from high-rise buildings, nor does it come from absolute luxuries. The core Indian kind of happiness is...

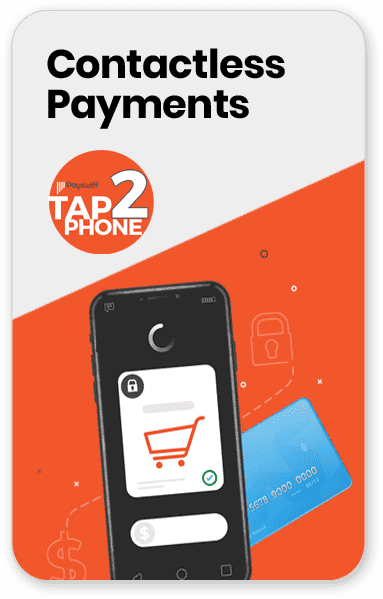

Payswiff’s Soundbox – Another step to digitalization

With the changing environment & digitalization that is evolving towards cashless society, merchants who accept digital payment are the fundamental responders to the change. Trying to regularly monitor these payments is necessary, but it can be very tedious and...

Role of HR in promoting diversity and inclusion

Businesses that value diversity and inclusion are generally innovative and adaptable, surpass their equivalents, and draw a much broader range of consumer satisfaction. These measures help businesses gain a competitive edge in the market and a favourable reputation....

Cash vs Digital Payment: The Change in Indian Perspective

Cash transactions vs Digital Transactions How has digital transaction helped every Indian merchant grow their business manifold? When it comes to managing your money, how you choose to pay or receive your money is just as important as the amount of money you make....

Why is Cloud Technology required for secure real-time payments?

The global pandemic contributed to the growth of contactless cards and payments, leading to a surge in the number of digital transactions. In today’s times, faster and safer payments have become a norm for businesses and consumers alike. It is becoming essential for...

Trusted Industry Partner